Re-imagining the Home Lending Process

The Company

Roostify provides a SAAS POS white-label product that allows consumers to apply for a loan and lenders to ask for evidentiary documents, making the home mortgage process easier.

The Problem Space

The home lending process is complicated, involving many handoffs and legal requirements that can create a lot of churn. In this space, Roostify wanted to provide a better borrower and lender experience.

The Project

Roostify wanted us to understand the current lender and borrower experience and provide recommendations regarding UX functionalities and product strategy.

They wanted their product to:

Serve the borrower better

Have Roostify be the central hub of communication throughout the mortgage process

My Role

Researcher, Designer, Strategist, and Project Manager as part of a 2 person team.

My Approach

Research Target

We heard from Roostify that they wanted a better lender and borrower experience - but then we had to break that down.

Borrowers

Borrowers broke down into:

People buying their first home

People who had multiple mortgages

People who were refinancing a mortgage.

Lenders

When looking at the lender space, Roostify only engaged with loan officers, but when we learned about the mortgage process, we understood that many other players interacted with a mortgage from the lender side. Loan officers have processors, underwriters, and other admins who also shape the borrower's experience.

Geographic Spread

We also understood that the Bay Area was a unique market when it came to home buying, so we had to broaden the geographical scope of our research. We worked with a recruiting agency to do onsite interviews in Kansas City, Tampa, Sacramento, San Diego, and the Bay Area.

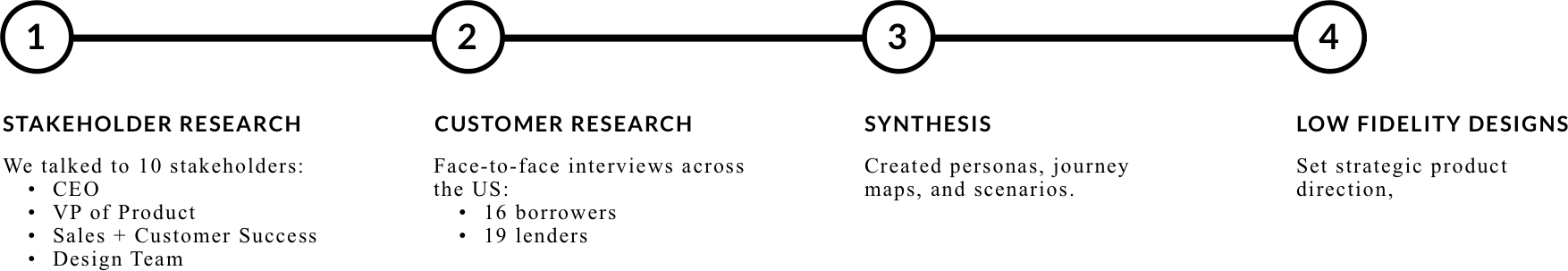

Research Approach

We did generative research to understand the full lifecycle and ecosystem around getting a loan so that we could identify pain points and opportunities.

Research Insights

In our research, we found that there were many preventable reasons for why loans were being denied. Moreover, we found that Roostify, as it currently stood, was adding to user complexity than solving it.

Tactical Pain Points

Lender:

Multiple communication channels for connecting with borrowers and those within their organizations prevents them from understanding the aggregate history of decisions made.

Multiple document repositories require lenders to hand hold customers through the document collection process. Moreover, lenders have difficulty remembering which documents are required by each different loan type.

Lenders don’t know what the ticking bombs are. This leads to missed deadlines, a lot of rework, and frustrated customers.

Borrower:

Many borrowers don’t know how to strategize about their loan structure - what type, how much to put as down payment, and who should be on the loan.

Strategic Pain Point

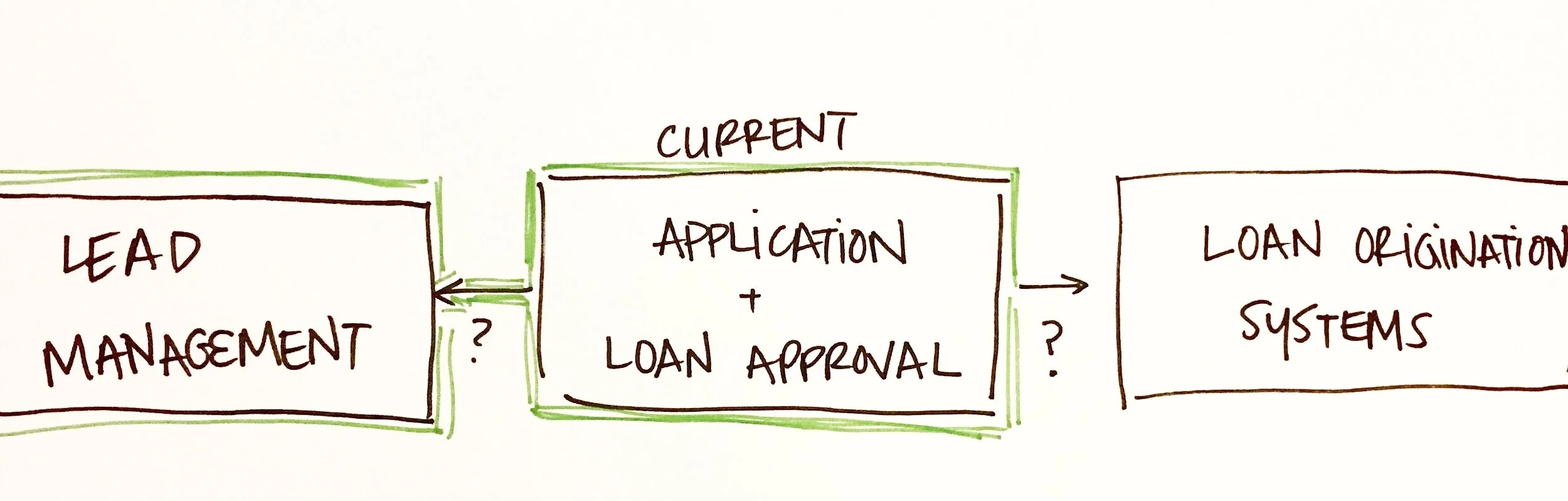

Different systems (like Roostify) support the loan through different phases and they aren't integrated well. This impacts the loan process as information gets lost between systems.

Lender & Borrower Personas and Journeys

We broke our research down by user type (e.g. loan officer, processor, first time home buyer, refinancer) and mapped out their user journeys. We then looked at how those user journeys fit into the larger mortgage lifecycle. We also mapped different borrower approaches to the mortgage process to determine clusters, and found that some borrowers wanted to be more hands-on, whereas others wanted the pace of the process to be more relaxed. We used these inputs to create personas.

Borrower Personas & Journeys

Lender Personas

AHA Moment!

We discovered a strategic business opportunity.

We identified that to not just be another overlapping system in a complicated process, Roostify should expand its offering to provide a more unified experience for the user. Roostify had two options for expansion, towards the beginning of the funnel which is lead management or towards the end, loan origination systems.

We showed that if they wanted to be the central hub of communication, they had to be the first point of communication. Roostify should own the lead management systems, and once they do, tackling the loan origination systems would be a no-brainer. Though tackling lead management seems like serving the lender instead of the borrower, making the lender well-equipped and owning the history of communication with the borrower has the greatest positive effect on the borrower.

We presented this idea along with our personas and wireframes of the solution to set the design foundation of the new lead management offering.

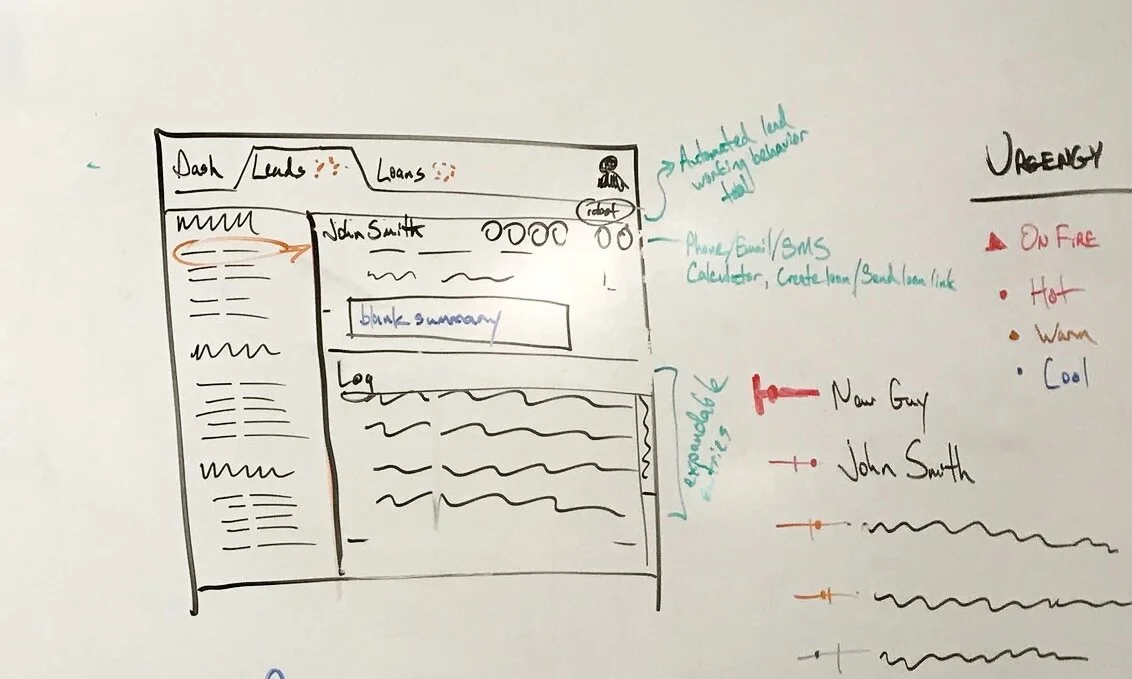

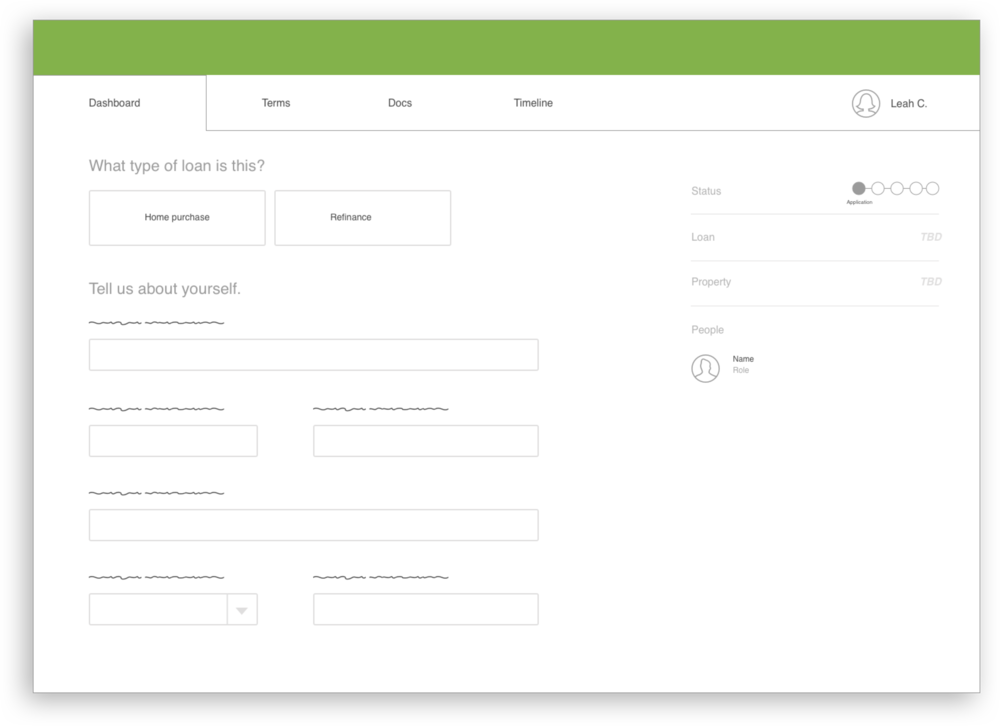

Setting the Foundation for Lead Management

How could lenders manage leads and loans within the same platform? We ultimately landed on a platform concept with three distinct spaces:

Dashboard - where the user will receive all action items, across leads and loans

Leads - where the user will have a prioritized list of leads, and the functionality to turn a lead into a loan, by triggering an application.

Loans - where borrowers and lenders can collaborate on document collection and loan processing.

With the lender dashboard receiving team-wide support, the structure of the platform fell into place.

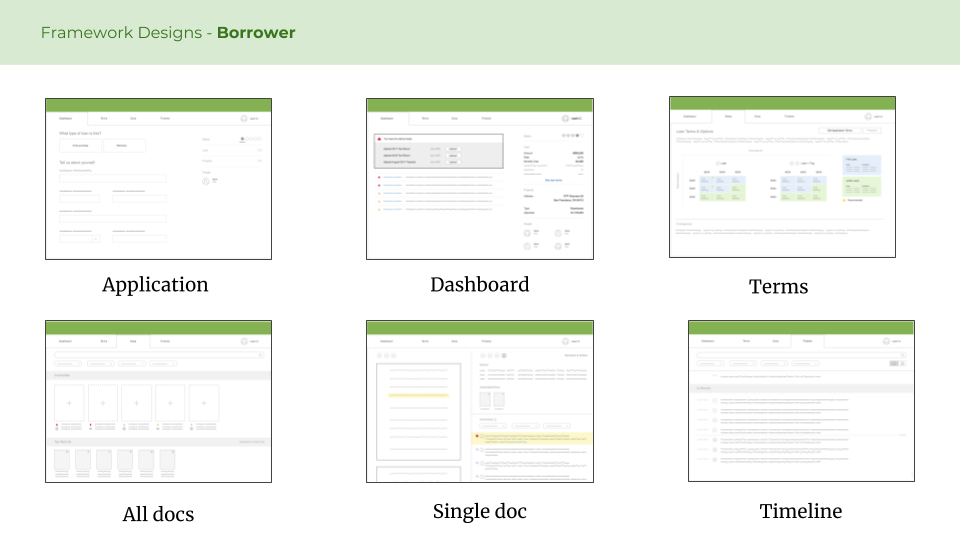

The structure helped us flesh out the designs of the platform's key screens.

Solving Multiple Communication Channels

Lenders and borrowers communicate through emails, texts, and phone calls, and somewhere in this mess, they lose track of things they had to do and decisions that were made.

We recommended Roostify consolidate all external messaging such as emails, texts, and phone calls into the system to have a single record of communication. We introduced the concept of pings, which encompassed all moments of communicating with the borrower.

Ping Diversity

Pings vary in content and complexity, but are presented in a consistent visual design framework in the dashboard and are always actionable.

Pings can be:

Messages/Emails

Requests for / Submitted Documents

Incomplete Tasks

System communications

The Biggest Ping is the Mortgage Application

We even treated a borrower's loan application as the biggest Ping in the system as it is a borrower's first action item and sets the foundation of the experience.

Designing Smart Document Collection

To handle the pain of multiple document repositories, we created a smart system that predicts needed documents based on loan type and a Document Library that prioritizes incomplete requests and allows for third party integrations such as Turbo Tax.

Key Takeaways

1. We convinced Roostify to consider and tackle a new product offering through our research and designs.

2. We pushed Roostify to be innovative when it comes to managing communication - why CAN'T one system manage texts, emails, and phone calls?

3. We provided greater clarity around documents needed and provided, the key offender in loans getting unnecessarily rejected